Both domestic sales and export markets have their own merits and value. Preference to invest in export sales distribution is largely driven by type of product or business services, resources available and risk taking ability. Most of the businesses have limited investment capital and there are times when many face the crossroads – which of the two is a better option for investment?

One thing that is common between domestic channel expansion and indirect export market entry is that both can provide increased margin. Both offer revenue growth on sustainable basis.

A domestic market expansion has always been a favorite investment option for many companies. Primarily because businesses tend to avoid undue payment risks and stick to familiar ground. Another major advantage of the domestic market is that one can be flexible with investment size or market entry route including direct sales to customers.

Generally selling overseas requires thorough research and export planning. It also leads to higher working capital requirements long credit cycles. Investing resources to build export markets can be an attractive long-term investment option as the return increases over time. A well planned strategy and with right distribution partners, exports have potential to deliver incredible profits.

So, why it is important to invest in building export market distribution?

Investing time, money and resources in export sales channel expansion scores over domestic distribution for various reasons. 7 major benefits are as below;

Diversified Income

Whether a manufacturer exports to multiple countries or one continent, exports has the potential to generate diversified income for the company. This also takes away risk of being totally dependent on one market or domestic market.

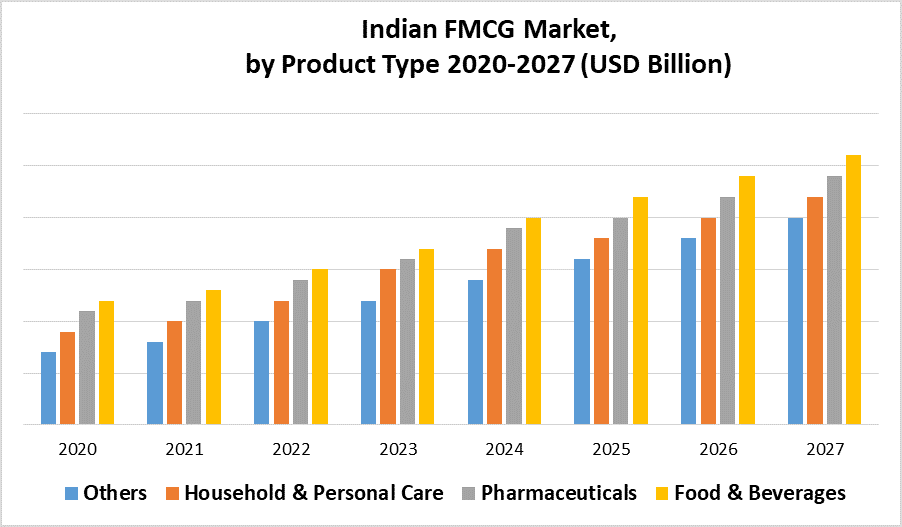

Potential Rate of Return

Generally, exports markets have potential to realize 15%-20% higher gross margins. The margin tends to improves with the market and economy growth.

In domestic market inflation directly affects the sales margin. This means that the return from domestic market is generally proportional to the inflation. Any depreciation in domestic currency (typical of emerging markets), also makes the return nominal.

Volatility and Risk

Domestic market is a somewhat stable investment option, which comes with low risks. On the other hand, exports sales have inherent risks. Insurance tools and modern trade instruments are commonly used to mitigate export risks to manageable levels. Still due diligence and knowledge of regulatory procedures is the key to manage exports.

Expenses add to the Value

One may argue that exports incur additional cost of approvals, labelling, qualification with local bodies. Overcoming trade and tariff barriers, can be really cumbersome unlike domestic market. However, this cost not only opens new markets, but also adds to brand equity in both domestic and international markets. Thereby, helping to command premium pricing over local competitors.

Long-term Value Creation

It is a fact that the inherent share value of company increases once the exports sales start rising in international markets. This builds confidence among all company stakeholders including investors, customers, vendors and employees. It also creates pull for domestic distributors and options for franchise model.

Aids the Economy

Exports also support many other sectors of economy and build reserves for the country. It helps economy in debt servicing, import payments, constraining fiscal deficit and various others economic parameters. Foreign Exchange reserves also create substantial traction for informal economy and generates indirect employment opportunities. Besides boosting country prestige and weight in policy matters.

Tax INCENTIVES on Exports Sales.

The investment in exports comes with numerous tax benefits. Many governments promote export oriented units by designating special economic zones, subsidized capital loans, tax rebates and other tax benefits for export oriented manufacturing units.

Conclusion

Thus, the indirect overseas sales expansion not only generates better returns, it also enhances company net worth over a period of time. It is a great investment option for many reasons such as a tax advantage, reduced payment and trade risk as compared to direct exports.